Paul Rosenberg, CEO of mCig (OTC: MCIG), recently publicized a small purchase he made, buying $100K of convertible preferred shares, but he appears to have failed to file a Form 4 to indicate a very large disposition of convertible preferred shares during the year ended April 30, 2016. The SEC requires that he do so, per its rules:

FORM 4

STATEMENT OF CHANGES OF BENEFICIAL OWNERSHIP OF SECURITIES

The Commission is authorized to solicit the information required by this Form pursuant to Sections 16(a) and 23(a) of the Securities Exchange Act of 1934, and Sections 30(h) and 38 of the Investment Company Act of 1940, and the rules and regulations thereunder. Disclosure of information specified on this Form is mandatory. The information will be used for the primary purpose of disclosing the transactions and holdings of directors, officers, and beneficial owners of registered companies. Information disclosed will be a matter of public record and available for inspection by members of the public. The Commission can use it in investigations or litigation involving the federal securities laws or other civil, criminal, or regulatory statutes or provisions, as well as for referral to other governmental authorities and self-regulatory organizations. Failure to disclose required information may result in civil or criminal action against persons involved for violations of the Federal securities laws and rules.

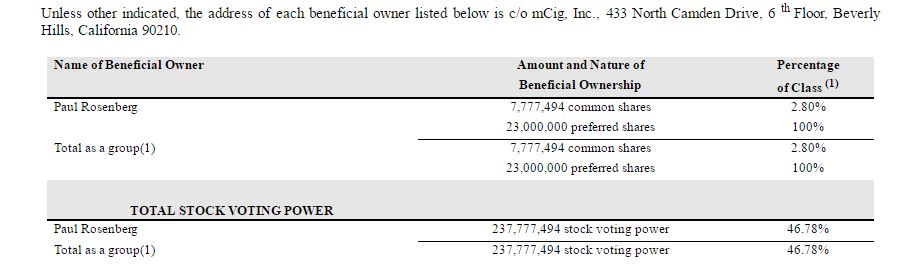

From inception, CEO Rosenberg has 23mm shares of Convertible preferred stock, convertible into 230mm common shares. In the 10-K for FY15, he still owned the shares, as of April 30, 2015:

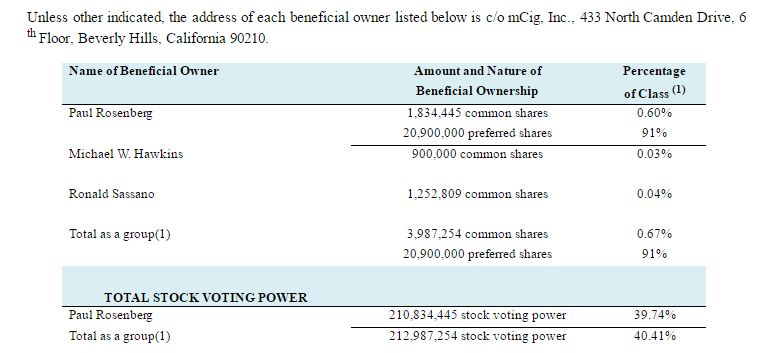

A year later, the 10-K for FY16, which was filed in September, revealed that he had not 23mm but 20.9mm as of April 30, 2016:

Not only had the number of preferred shares declined, but the number of common shares declined as well, with Rosenberg holding almost 6mm fewer shares, 1.834mm compared to 7.777mm in the prior year. The reduction of 2.1mm convertible preferred shares is equivaltent to 21mm common shares. When added to the common shares, he appears to have reduced his stake by almost 28mm shares.

Rosenberg clearly failed to file a Form 4 during that time-frame, as the company had no Form 4s filed:

Rosenberg had locked his convertible preferred shares up until April 30, 2015, as disclosed in the 10-K from FY15:

On September 23, 2013, the Company entered into a Share Cancellation / Exchange / Return to Treasury Agreement with Paul Rosenberg, the chief executive officer of mCig, Inc., for the cancellation of 230,000,000 shares of our common stock held by Mr. Rosenberg in exchange for 23,000,000 shares of our company’s Series A Preferred Stock. The Series A Preferred shares of mCig, Inc. carry ten (10) votes per each share of Preferred stock while mCig, Inc’s common shares carry one (1) vote per each share outstanding. Consequently, the result of all matters to be voted upon by the shareholders may be controlled by Mr. Rosenberg, who can base his vote upon his best judgment and his fiduciary duty to the shareholders. Mr. Rosenberg has a lock up contractual agreement to not convert the Series A Preferred shares until April 30, 2015. After this time (and as of the date of the filing of this report), he may convert the shares to common stock, substantially diluting the common shareholders. As the sole director and the holder of the majority of capital voting shares there is a risk that Mr. Rosenberg can reverse his decision or convert his Series A Convertible Shares after April 30, 2015, significantly diluting the common stock. There are no plans or intentions for Mr. Rosenberg to convert his Series A Preferred Stock at present or after April 30, 2015.

Similar language was included in the 10-K for FY16, noting the reduction as well:

On September 23, 2013, the Company entered into a Share Cancellation / Exchange / Return to Treasury Agreement with Paul Rsenberg, the chief executive officer of mCig, Inc., for the cancellation of 230,000,000 shares of our common stock held by Mr. Rosenberg in exchange for 23,000,000 shares of our company’s Series A Preferred Stock. As of April 30, 2016 Mr. Rosenberg owned 20,900,000 Series A Preferred. The Series A Preferred shares of mCig, Inc. carry ten (10) votes per each share of Preferred stock while mCig, Inc’s common shares carry one (1) vote per each share outstanding. Consequently, the result of all matters to be voted upon by the shareholders may be controlled by Mr. Rosenberg, who can base his vote upon his best judgment and his fiduciary duty to the shareholders. Mr. Rosenberg has a lock up contractual agreement to not convert the Series A Preferred shares until April 30, 2015. After this time (and as of the date of the filing of this report), he may convert the shares to common stock, substantially diluting the common shareholders. As the sole director and the holder of the majority of capital voting shares there is a risk that Mr. Rosenberg can reverse his decision or convert his Series A Convertible Shares after April 30, 2015, significantly diluting the common stock. There are no plans or intentions for Mr. Rosenberg to convert his Series A Preferred Stock at present or after April 30, 2016.

The last line is comical, as the 10-K was filed on 9/1/16 and also included this subsequent event buried in the filing:

On June 8, 2016, Paul Rosenberg converted 600,000 shares of Series A Preferred Stock into 6,000,000 shares of common stock.

In the most recent 10-Q for the quarter ending 10/31/16, there was an indication of further reductions, though on favorable terms for the company:

The Company has authorized 50,000,000 shares of preferred stock, at $0.0001 par value and 17,000,000 and 23,000,000 are issued and outstanding as of October 31, 2016 and April 30, 2016, respectively. Each share of the Preferred Stock has 10 votes on all matters presented to be voted by the holders of the Company’s common stock. All of the 23,000,000 shares of issued and outstanding preferred stock were granted to the Company’s Chief Executive Officer on September 23, 2013, which was valued at $2,300, the price of the common stock of $0.0001 exchanged in the transaction. On September 25, 2016 the Company’s CEO sold back to the Company 5,000,000 shares of Preferred Stock in exchange for $500 (par value). The Company’s CEO currently owns 16,000,000 shares of Series A Preferred on October 31, 2016.

The math isn't adding up, as 20.9mm as of 4/30/16 less the 0.6mm conversion on June 8, 2016 would have left him with 20.3mm shares. A reduction of 5mm would have resulted in 15.3mm and not 16mm, as the 10-Q indicated.

The company and its CEO appear to have failed to ever properly disclose the transaction that resulted in Rosenberg's disposition of 2.1mm preferred shares or his reduction in common shares from FY15 to FY16.

Recent free content from Cannabis Analyst

-

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

-

420 Investor Weekly Review 12/23/22

— 12/26/22

420 Investor Weekly Review 12/23/22

— 12/26/22

-

420 Investor Weekly Review 12/16/22

— 12/16/22

420 Investor Weekly Review 12/16/22

— 12/16/22

-

420 Investor Weekly Review 12/09/22

— 12/09/22

420 Investor Weekly Review 12/09/22

— 12/09/22

-

420 Investor Weekly Review 12/02/22

— 12/02/22

420 Investor Weekly Review 12/02/22

— 12/02/22