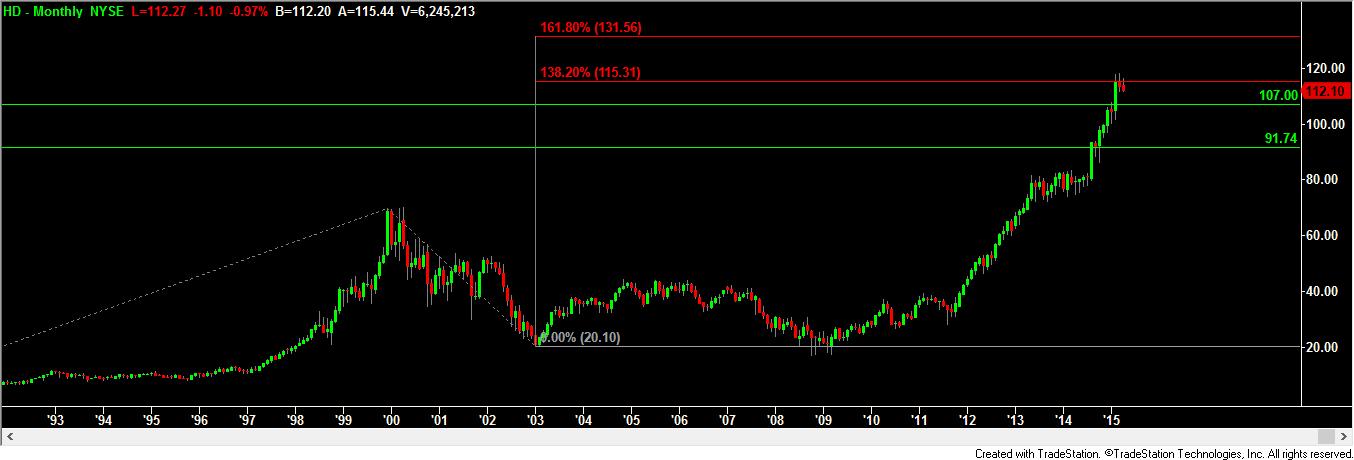

Home Depot may have just completed a very long-term “third wave thrust” to the upside when it peaked out at $117.99 in March. Going back to the inception of HD’s trading back in December of 1991, the $115.31 level represented at 138.2% Fibonacci price projection line for this third wave on a monthly chart. The fact that HD traded above that level intra-month and then closed back below that level (for the second month in a row, by the way), lends credibility to the idea of this being a short-term peak for the stock. There are two possible pullback scenarios from here: first, a pullback to around $107 which would then be followed by a move up to the next Fibonacci projection at $131.56; or, a deeper correction down to $91 which would only be followed by a retest of the $115.31 resistance. Much of that may depend on whether the S&P holds support at 2030 (on the futures). Watch the action carefully at around $107.

Recent free content from Peak Analytics & Consulting

-

S&P futures may see short-term bounce ahead of test of 4,005

— 8/26/22

S&P futures may see short-term bounce ahead of test of 4,005

— 8/26/22

-

NASDAQ futures update...

— 3/08/22

NASDAQ futures update...

— 3/08/22

-

AAPL historical pattern could lead market lower

— 8/03/20

AAPL historical pattern could lead market lower

— 8/03/20

-

UPDATED S&P FUTURES LEVELS BASED ON TODAY'S ACTION...

— 12/20/18

UPDATED S&P FUTURES LEVELS BASED ON TODAY'S ACTION...

— 12/20/18

-

Headed to 2412 - 2417

— 12/20/18

Headed to 2412 - 2417

— 12/20/18

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member