Darling Ingredients (NYSE: DAR) is a decidedly unique company. Its business is to take raw material waste product, the kind that often ends up in our streams and water ways, and turns it into value-added processed materials that can be used in a range of industrial and agricultural settings. Darling has customers in the food, pharmaceutical, cosmetic and neutra-ceutical industries.

Let me give you some examples of the kinds of things Darling creates: gelatin from animal hooves, biofuel from municipal waste gas emissions, and animal fats, and organic fertilizers from large-scale factory farm waste.

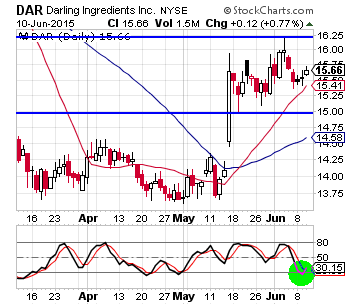

To be sure, Darling is in the midst of a tough year, and narrowing profit margins are expected to lead net income to fall by more than half. The good news is that the drop in earnings has already been priced in. Shares of DAR hit a low back in late April and have been in rally mode ever since (see chart).

Looking ahead, analysts now expect earnings per share to double in 2016 (to around $0.83), and approach $1 a share by 2017. Thus you are able now, even after the rally, to leverage your investment dollars nearly three-fold over the next two years.

Look at its growth in sales. Strategic acquisitions have helped Darling grow sales from $600 million in 2009, to $1.7 billion in 2012, to around $3.7 billion this year. This time next year we could see sales top the $5 billion mark.

Once we factor in all the projected growth, we see that Darling's shares trade for less than seven times projected 2016 EBITDA. That multiple shrinks to six when you account for normalizing business conditions which should obtain once the dollar and commodity prices stabilize.

More good news: management is on record as stating that it will use the company's robust cash flow to pay down debt, and as that happens, the pro forma enterprise value in 2017 would stand at around $3.5 billion, making current share price a real bargain.

Taken together, buying this green-clean fuel/feed producer at a bargain price in the expectation of strong growth over at least the next two years make shares of Darling Ingredients a "BUY NOW" recommendation.

Recent free content from Dr. Thomas Carr

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member