A momentum stock is defined as a stock whose share price is in an accelerating uptrend. Momentum stocks are typically some of the most widely traded of all stocks. Why is that? The answer is simple: momentum stocks move the furthest in price in the least amount of time. Further and faster than value stocks. Further and faster than growth stocks.

Forbes magazine claims that "momentum strategies can help investors beat the market and avoid market crashes." Even Nobel Prize winning economist Eugene Fama had to admit that his "efficient market theory" could not account for the positive correlation between current momentum and future gains.

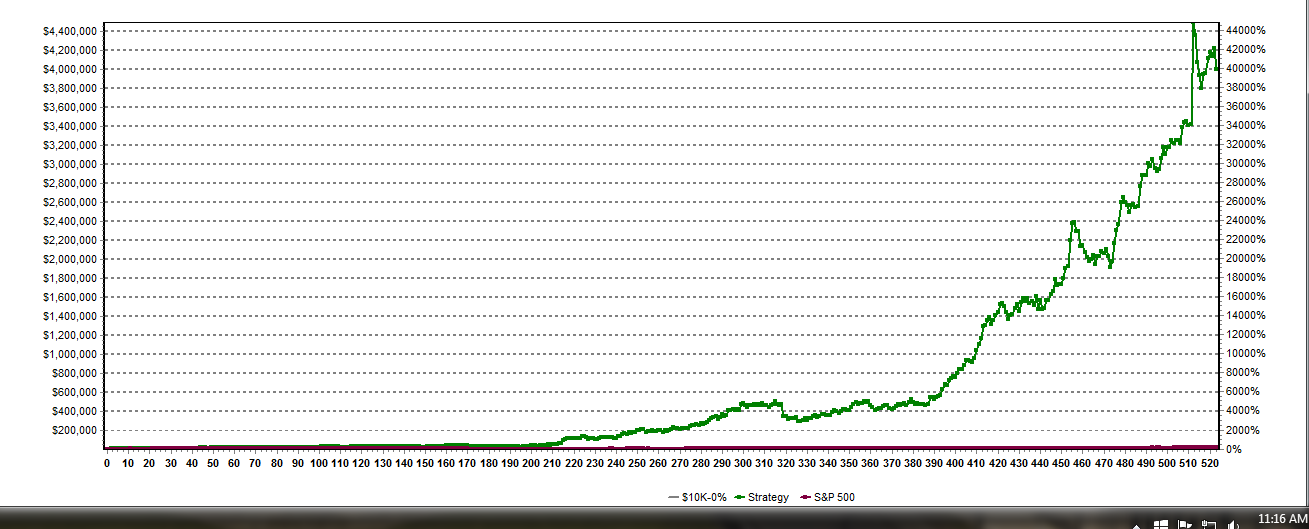

Momentum is arguably the strongest force moving the market. To show you what I mean, take a look at the historical returns for the system I use in The Momentum Letter (DrStoxx.com). Over the past 10 years (through June 30, 2015), my primary longs-only momentum system has returned an astounding 39,000%:

With that kind of compounding, a $10,000 investment today could balloon into nearly $4,000,000 by the year 2025!

But there is a dirty little secret about most momentum systems: they lose money over time. Let me prove my point. In the following free webinar I recorded a few months ago, I lay out the reasons why most momentum traders lose money. Take a look:Recent free content from Dr. Thomas Carr

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member