The State of the Markets:

Happy Monday and welcome back to the land of blinking screens. I don't know about you, but I've been intrigued lately by all the projections/prognostications that analysts feel compelled to provide at the beginning of each year. So, just for fun, I thought I'd join in the game this year.

To be clear, I do NOT manage money based on predictions, macro views, or the proverbial gut hunches. No, I prefer to stick to the weight of the evidence from a plethora of market models. I strive to keep portfolios positioned in line with what "is" happening in the market and not what I think "should" to be happening in the market. I learned a LONG time ago that Ms. Market doesn't give a hoot about what I think "ought" to be happening in her game and that my primary job is to try and get it mostly right, most of the time.

However, I'm also known in the business as a bit of a model geek. So, I decided to try my hand at "modeling" the outlook for the S&P 500 this year. But as I hope I've made clear, this is a "just for fun" exercise.

The Market Drivers

I decided to start with what I believe to be the primary drivers of stock market returns. Namely the economy, earnings, monetary conditions, inflation, the technical health of the market, and historical market cycles.

I then dug into my trusty model toolbox and dug out indicators and/or models for each of these components. Or in some cases, I combined multiple models to create a composite model.

The Models

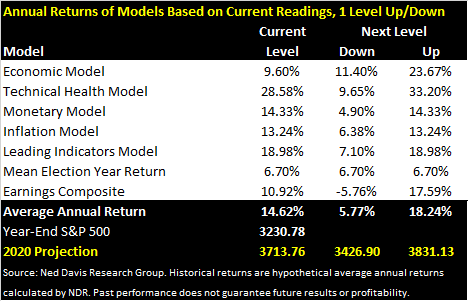

I wound up with seven models. Next, I looked at the average annual historical return of the S&P 500 for the current reading/mode of each model. I have to give a hat tip to the computers at Ned Davis Research Group for this data. I then averaged the historical returns and applied it to the S&P's year end closing price of 3230.78. This gave me a projection for year.

As the first column in the chart below details, the average historical return given the "Current Level" of the models has been +14.62%. This produces a 2020 projection of 3714. Not too shabby, right?

Playing What If

But, but, but... The flaw in the ointment here is that things change in the market game - sometimes quickly and monumentally. The most obvious example of a model that can change dramatically in a relatively short period of time would be the Technical Health Model, which measures the technical state of 157 sub-industry groups on a weekly basis. In other words, this is a price-based model that is likely to change throughout the next 12 months.

With this in mind, I decided to look at the historical returns of the models if they ALL moved DOWN one notch in their readings/modes.

Not surprisingly, the average historical return drops from +14.6% to +5.77%. This is actually more in line with the throngs of Wall Street analysts who are calling for "low, single-digit returns" this year. Interesting.

Next, since I'm a card-carrying member of the-glass-is-half-full club, I decided to also look at the average historical returns for the models if the reading/modes moved UP one notch from current levels. Given that several of the models are already in their most upbeat modes, the average annual historical return wasn't too dramatic - the average increased only to +18.24%. But again, I'd certainly take a high teens gain in 2020!

Summing Up

Finally, I decided that saying the market should rise between 5.8% and 18.2% was a bit of a cop out as that's a pretty big range!

What I'm going to do then is take the average of the "Next Level Up/Down" returns as my "final answer." So, drum-roll please... My "just for fun," model-based guesstimate for the S&P 500 in 2020 is 12.0%. This would put the close next New Year's Eve at 3618.47. That's my story and I'm sticking to it. Unless of course, things change - then I'll simply do what I always do and adapt to conditions - ha!

Weekly Market Model Review

Since it's the start of a new week, it's now time to put aside my subjective view of the action and to review the "state" of our indicator boards. Each week we do a disciplined, deep dive into our key market indicators and models. The overall goal of this exercise is to (a) remove emotion from the investment process, (b) stay "in tune" with the primary market cycles, and (c) remain cognizant of the risk/reward environment.

The Major Market Models

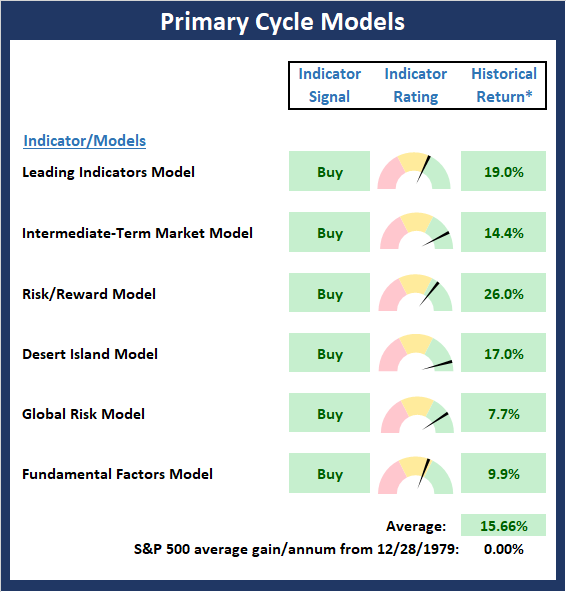

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

The are no changes whatsoever to the Primary Cycle board this week. So, as I've been saying for many moons now, the status of my favorite big-picture market models continues to suggest that the bulls are in charge of the game and that investors should keep their offense on the field.

This week's mean percentage score of my 6 favorite market models held rose to 74.3% from 71.8% while the median upticked to 75.0% from 72.5%.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

View My Favorite Market Models Online

The State of the Fundamental Backdrop

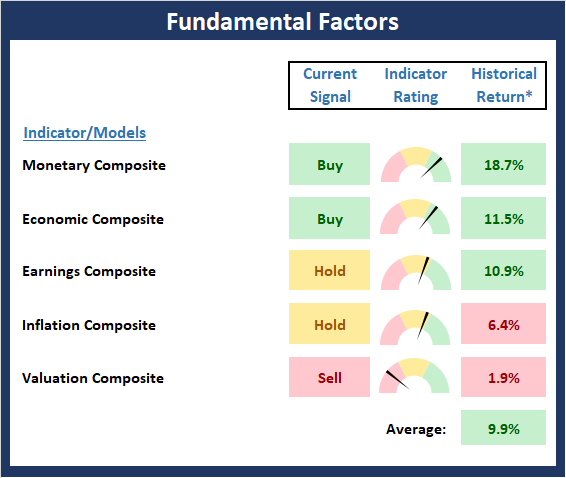

Next, we review the market's fundamental factors in the areas of interest rates, the economy, inflation, and valuations.

Ditto for the Fundamental Factors board, as the status of the board held steady this week. From my seat, this board tells me to look at 2020 from an upbeat perspective. What would change my view, you ask? If either the economic or earnings composite were to move into negative territory, or if the Fed would need to shift their stance, then I would likely consider moving to a less offensive stance.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

View Fundamental Indicator Board Online

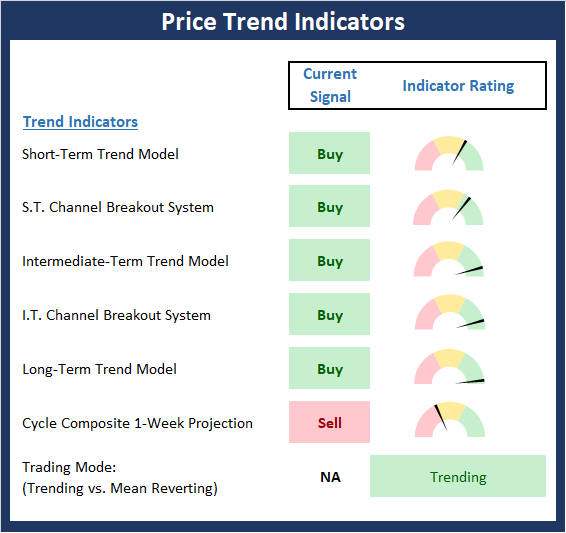

The State of the Trend

After looking at the big-picture models and the fundamental backdrop, I like to look at the state of the trend. This board of indicators is designed to tell us about the overall technical health of the current trend.

Frankly, I'm a little surprised that the Trend board remains in such good shape. I'm likely not the only investor who has been expecting the bears to make a stand at some point here. But despite the drama in Washington and what looked for a minute like a hot war in Iran, any/all dips continue to be bought. And until this trend changes, one must give the bulls the benefit of any/all doubt.

NOT INDIVIDUAL INVESTMENT ADVICE.

View Trend Indicator Board Online

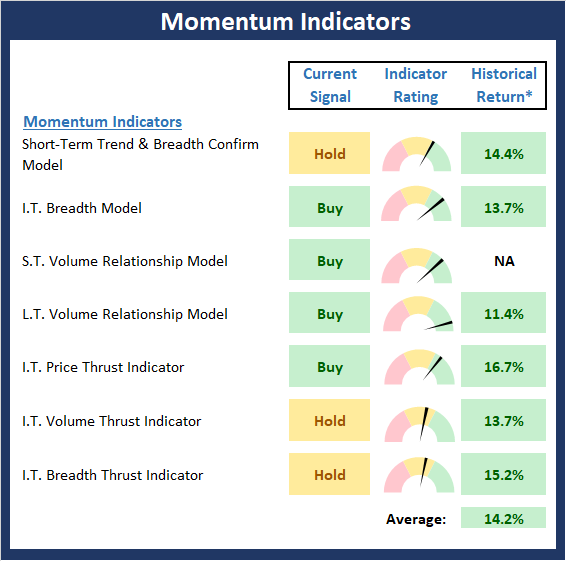

The State of Internal Momentum

Next, we analyze the "oomph" behind the current trend via our group of market momentum indicators/models.

Despite a little slippage in the indicators last week, the Momentum board remains in pretty good shape. To be clear, the board is not in pound-the-table bullish shape. However, it is certainly "good enough" to keep the bulls in business.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

View Momentum Indicator Board Online

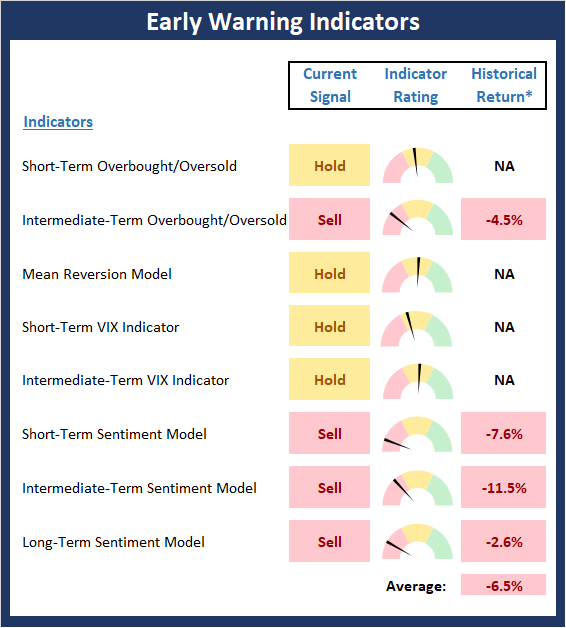

Early Warning Signals

Once we have identified the current environment, the state of the trend, and the degree of momentum behind the move, we then review the potential for a counter-trend move to begin. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

The Early Warning board continues to act like a 3rd grader in the back of the class desperately waving his hand because he/she knows the answer to the question the teacher has asked. The bottom line is the market remains overbought and sentiment is overly positive. Thus, the table is indeed set for our furry friends in the bear camp. But as I wrote last week, the big question is if the bear camp will be able to do anything with their opportunity. Finally, it is important to remember that when a market gets overbought and stays overbought, it is a positive. In other words, this is known as a "good overbought" condition and a sign of strength. However, I'm probably not the only one feeling a little deja vu here (January 2018) and wondering what is going to come out of the woodwork next.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

View Early Warning Indicator Board Online

Thought For The Day:

A fool thinks himself to be wise, but a wise man knows himself to be a fool. -Shakespeare

The ALL-NEW 2020 Daily Decision Model Portfolio

NEW PORTFOLIO STRATEGY FOR 2020!

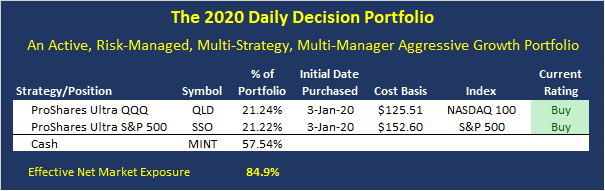

About The Portfolio: The Daily Decision Model Portfolio is an aggressive, actively risk-managed, multi-strategy, multi-manager approach. The primary objective of the portfolio is to stay in tune with the major market cycles - both bull and bear. However, the portfolio will, at times, actively manage exposures based on shorter-term moves. In addition to "timing" moves, the portfolio will utilize levered positions via ETFs and may hold an effective net short position during negative cycles.

Strategy Diversification: The 2020 DD Portfolio utilizes a well diversified approach. The management strategy incorporates multiple trading strategies so as to avoid the "singular failure" problem that can occur when a single strategy is out of sync. There are a total of 9 different trading strategies working in the 2020 DD Portfolio. Three "turbo-charged" aggressive beta strategies. Three mean reversion strategies. And three risk-management strategies. In addition, there are three separate managers working in the portfolio.

An Actively Traded Approach: We anticipate the portfolio will trade 2-3 times a week and hold between two and four ETF positions. Finally, please note that the Daily Decision Portfolio strategy is aggressive in nature and thus, drawdowns can and will occur. However, we believe the strategy will rebound quickly after temporary pullbacks.

Current Positions

Below are the current positions for the 2020 Daily Decision Model Portfolio.

Testing The Trading Systems

In my humble opinion, it would be foolish to utilize any trading approach without first testing the strategy. However, when you combine strategies that have never been combined before, you have a hypothetical strategy. As such, you must do a back test on the combination.

There is a well known saying in the investment management business relating to hypothetical tests of trading systems that goes a little something like this: "Back tests are bull*#$!"

To be sure, there are problems involved with back testing, not the least of which is curve fitting. I.E. making your system fit the data provided. This is what happens when inexperienced traders try to develop systems that would have done well historically.

However, our approach here is different. We aren't using back testing to develop strategies to trade the market. No, we are testing a combination of EXISTING systems in effort to create "proof of concept." In other words, does a certain combination of systems developed by different managers work well together over time?

Wishing You All The Best in Your Investing Endeavors!

The Front Range Trading Team

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Position Disclosure:At the time of publication, the editors hold long positions in the following securities mentioned: SSO, QLD - Note that positions may change at any time.

Important Disclosures Relating to the Limitations of Back Testing:

The preceding summary of hypothetical performance is for illustrative purposes only and is not a solicitation or recommendation of any investment strategy.

There is no guarantee that investment results portrayed in this illustration will yield similar future results. All investments and/or investment strategies involve risk including the possible loss of principal. Consult an investment professional before investing in any investment program.

In the illustration we have utilized hypothetical back testing to create the performance record to reflect the manner in which an account could be managed. Hypothetical back tested performance results have many inherent limitations and do not reflect the actual results of any client account.

Hypothetical performance results are achieved by means of the retroactive mixing of portfolio strategies that was designed and prepared with the benefit of hindsight. No representation is being made that any strategy will or is likely to achieve profits or have losses similar to those shown. Hypothetical testing may not reflect the impact that any material market or economic factor may have on investment decision making. Further, the performance record in this illustration may have under or over compensated for the impact, if any, of certain market factors (e.g. lack of liquidity, trading costs, etc.). The conditions, objectives or investment strategies may have changed materially during the time period, or after the time period, portrayed in this performance record, and the effect of such change is not portrayed in the performance record.

Hypothetical back tested performance results are shown gross of management fees. Hypothetical back tested performance results are before trading and other custodian costs and do not consider the impact of taxes.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

Recent free content from FrontRange Trading Co.

-

The Lines In The Sand Are Clear

— 9/16/20

The Lines In The Sand Are Clear

— 9/16/20

-

The Question of the Day

— 8/04/20

The Question of the Day

— 8/04/20

-

Portfolio Update: 1.23.20

— 1/23/20

Portfolio Update: 1.23.20

— 1/23/20

-

Current Holdings for ALL-NEW 2020 Daily Decision Model Portfolio

— 1/03/20

Current Holdings for ALL-NEW 2020 Daily Decision Model Portfolio

— 1/03/20

-

INTRODUCING: The ALL-NEW Daily Decision Model Portfolio for 2020

— 1/03/20

INTRODUCING: The ALL-NEW Daily Decision Model Portfolio for 2020

— 1/03/20