We’ve all starting to hear a lot of comparisons between this year and 1968 now that racial tensions and riots have been added to the list of other wild developments for 2020. It sure seems like President Trump is taking a page from Richard Nixon’s 1968 campaign playbook by running on the issue of “law and order.” The GOP has certainly been the party most associated with the law and order issue, so it looks like President Trump wants to use that issue to help him during this election year...much like it helped Nixon in 1968.

However, the Administration is taking a risk in following this strategy. In 1968, Nixon was the challenger...and the sitting Administration (where his opponent was VP...Hubert Humphrey)...received a lot of the blame for CAUSING the lack of law and order and the riots. This time around, the GOP candidate is the sitting President, not the challenger. Therefore, he can be blamed for CAUSING the unrest...due to the fact that many people believe (rightly or wrongly) that his policies have created a greater chasm in the wealth gap.

Don’t get us wrong, a lot of the reasons people blamed the sitting administration for the social upheaval in 1968 had to do with the Vietnam War and not just race relations, so the comparison to that year is a complicated one. However, when a President is running for re-election (or when a sitting VP is running for a “third term”...like we saw in 1968), the election is always a referendum on the sitting President’s most recent four years.

Therefore, even if President Trump can calm things down right now by cracking down on the rioting, he just might merely be doing what he has been accused of doing several other times in the past: fixing a problem that he himself created. Thus, those who think that the President’s “law and order” strategy is one that will lead to his re-election...and that a GOP President is better than a Democratic President for the stock market...need to be careful. (This is especially true given how well the stock market did during the last two Democratic presidents.)

Anyway, as for the markets, we’re going to look across the pond at Europe this morning. Over the weekend, we highlighted how the European bank stocks are close to testing the upper end of their 2.5 month sideways range. If the STOXX Europe 600 Bank index can break above 96, we said, it would be quite positive on a technical basis...and that index is now just 1% from that level.

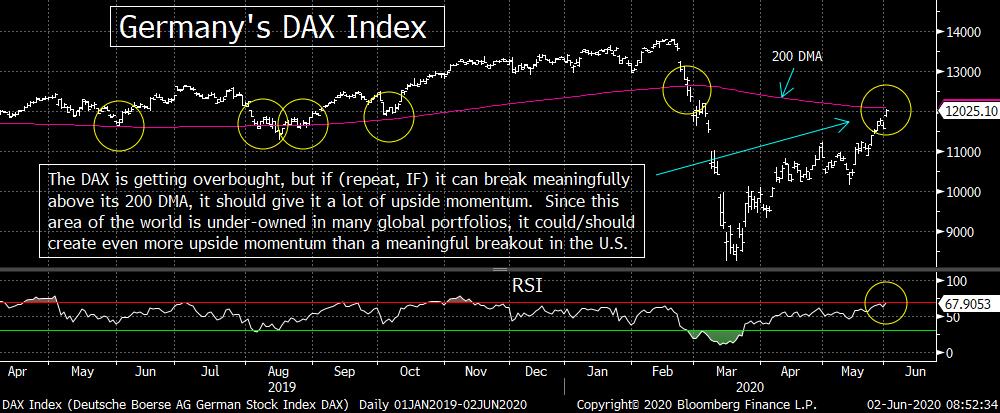

However, the bank stock index is not the only one in Europe that is testing a key resistance level. Germany’s DAX index (which was closed yesterday for a holiday) is rallying more than 3% this morning. This has taken the DAX up to the 12,000 level. More importantly, the rally has taken the DAX up to its 200 DMA...and this moving average has been a key line for the German stock index for quite a while. For much of 2019, the 200 DMA provided strong support. Once it broke below that key support line in March, the index fell out of bed (by dropping over 34%). Now, that “old support” level has become “new resistance”...so if the DAX can break above that 200 DMA in any meaningful way, it should be quite bullish for Germany’s stock market. (Needless to say, if the European banks stocks can breakout, it should help the broad stock markets in Europe continue to rally as well.)

However, we DO need to point out that the DAX is beginning to get quite overbought on a near-term basis. Therefore, it might have to take a short-term “breather” before it makes a serious attempt at breaking above this new (and important) resistance level. Of course, we also have to guard against the possibility that the 200 DMA does indeed provide excellent resistance for the DAX. If that’s the case...and German stocks roll-over in a very meaningful way...it would be quite negative.

In other words, Germany’s stock market is now at a important technical juncture. This might not be settled immediately...but the next big move in the DAX should be vitally important on how it acts over the rest of the summer. Again, if it can break above that 200 DMA in a meaningful fashion, it’s going to create even more upside momentum for German stocks...AND European stocks in general!. If, however, it fails...and rolls-over in a meaningful way...the failure at this key technical level will cause a lot of momentum money to head for the exits.

We’ll finish by summing up our thoughts on U.S. stocks vs. European stocks. We are cautious on the global markets at these levels, so we are skeptical about whether the European stocks can breakout right here. We’ve been saying the same thing about the U.S. stocks...saying that although the S&P 500 had broken above its own 200 DMA, we question whether it can do so in a “meaningful” way due to our concerns that the economy will stabilize at a lower level than we saw in 2019. HOWEVER, if we’re wrong...and both of these markets breakout...it is our opinion that the European market will have more upside potential.

That’s right, even though the fundamental picture is better in the U.S., the markets are not trading on fundamentals at all right now. European stocks are quite under-owned right now...and if anything, U.S. stocks are over-owned...at least compared to other stock markets around the globe. (In other words, U.S. stocks are more heavily weighted in most global portfolios than European stocks.) Therefore, if people see European stocks breakout in a meaningful way, they’re probably going to attract more momentum money than U.S. stocks. That means that one of the biggest surprises of the summer of 2020 just might end up being the outperformance of the European stock market. Again, a breakout is not our base case right now, but it will quickly become our base case if the DAX can breakout in a significant fashion over the coming weeks. If that takes place, investors should take a long look at the EWG German stock ETF.

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member