It's been a long while since silver is attracting attention from average buyers. Most people turn to buying gold whenever there are major geopolitical uncertainties. With the COVID-19 pandemic running rampant, especially during the recent months in the US, Brazil, and Mexico, gold has been running higher and higher, which is now trading above $1800 per ounce going closer to $1900.

But, in the recent couple of weeks, silver has been outpacing gold, and, it looks like it is finally breaking out of a near 10-year bear trend, and out of a tight pocket that has held in a trading range since 2015. Let's look at a monthly chart for AGQ (the 2x leveraged silver ETF):

In this chart, we can see that AGQ has been trading in a really tight range (relative to its lifetime trading range) since about 2015. On July 8, it broke above $30 and hasn't looked back. Yesterday, AGQ jumped more than +12%! If this breakout continues, we could see AGQ at about $100 in the coming months! Also, notice the rise in volume traded!

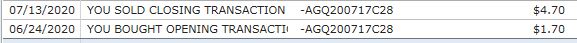

I have been trading AGQ calls:

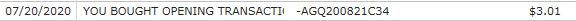

On June 24, I bought July 17 28 calls and sold them on July 13 (about two-and-a-half weeks) for a profit of +276%. I also bought more on July 20 of August 21 34 calls:

Because AGQ is a 2x leveraged ETF, it is much more volatile. If you're looking for a less volatile vehicle, SLV could be better for you.

Besides trading the silver ETFs, you might also want to consider silver miners. Silver miners have also been shooting up higher! Names such as PAAS, AG, SILV have all been doing well. A silver miners ETF, symbol SIL, may be appropriate, if you don't want to spend the time looking into each company.

If you want to look fro a penny stock, SILEF might be a good one to look into. It closed at $0.3159 yesterday.

Last checked, both gold and silver futures are up!

Good morning and HappyTrading! ™

Recent free content from Andy Wang

-

Stocks Coming Back Down

— 8/23/22

Stocks Coming Back Down

— 8/23/22

-

Stocks Ready For A Bounce

— 7/07/22

Stocks Ready For A Bounce

— 7/07/22

-

Consumer Stocks Take Hit: TGT, COST, DG, DLTR, MCD

— 5/18/22

Consumer Stocks Take Hit: TGT, COST, DG, DLTR, MCD

— 5/18/22

-

Two Quick Trades: FB, GME

— 5/12/22

Two Quick Trades: FB, GME

— 5/12/22

-

Dow Stocks Are Falling, and 3 Dow Stocks to Sell

— 5/12/22

Dow Stocks Are Falling, and 3 Dow Stocks to Sell

— 5/12/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member