While countries all over the world are experiencing heat waves and floods, the US is no exception. In June and July, many states saw temperatures rise above 100 'F; now, flooding is happening in multiple states.

However, due to political or other unintelligible reasons (like simply believing the wrong leaders), people are still wondering if "global warming" is for real.

But, one thing for sure, green energy is on the rise. EV cars have been slowly replacing gasoline cars. Now, with the latest climate change bill, solar stocks just got a boost.

Last week, solar stocks, such as ENPH, FSLR, SEDG, SPWR, RUN, all experienced pops greater than +20%! Solar stocks may have just started a new bullish phase in a not so bullish market environment.

Speaking of the overall market, a few weeks ago, I wrote an article, saying that the market was "ready for a bounce". Since then, SPX has jumped about 200 points! In that article, I mentioned to watch the SPX 3980 level, which the market had trouble staying above. Until, last Wednesday, when the Fed raised rates by the "expected" 0.75 and gave the impression that the rate of increase will slow soon, SPX finally broke and stayed above that level.

So, has the bounce turned into a rally? Let's see where the market indices stand:

SPX

SPX is testing the near-term resistance level right now, right around the 4130-4150 area. This is the "congested" or "undecided" area that manifested right before the dreadful June CPI report and prompted the Fed to gave its first 0.75 raise unexpectedly. That event caused stocks to drop precipitously, followed by 2 consecutive gap-down days! So, this 4130-4150 range should now become a resistance level.

Nasdaq

Tech stocks appear to be stronger, led by good earnings from GOOG, MSFT, AAPL, and AMZN. Nasdaq has already risen above its congested area back in June, which leads me to lean a bit more on the bullish side for the overall market right now. After all, the earnings season has just started.

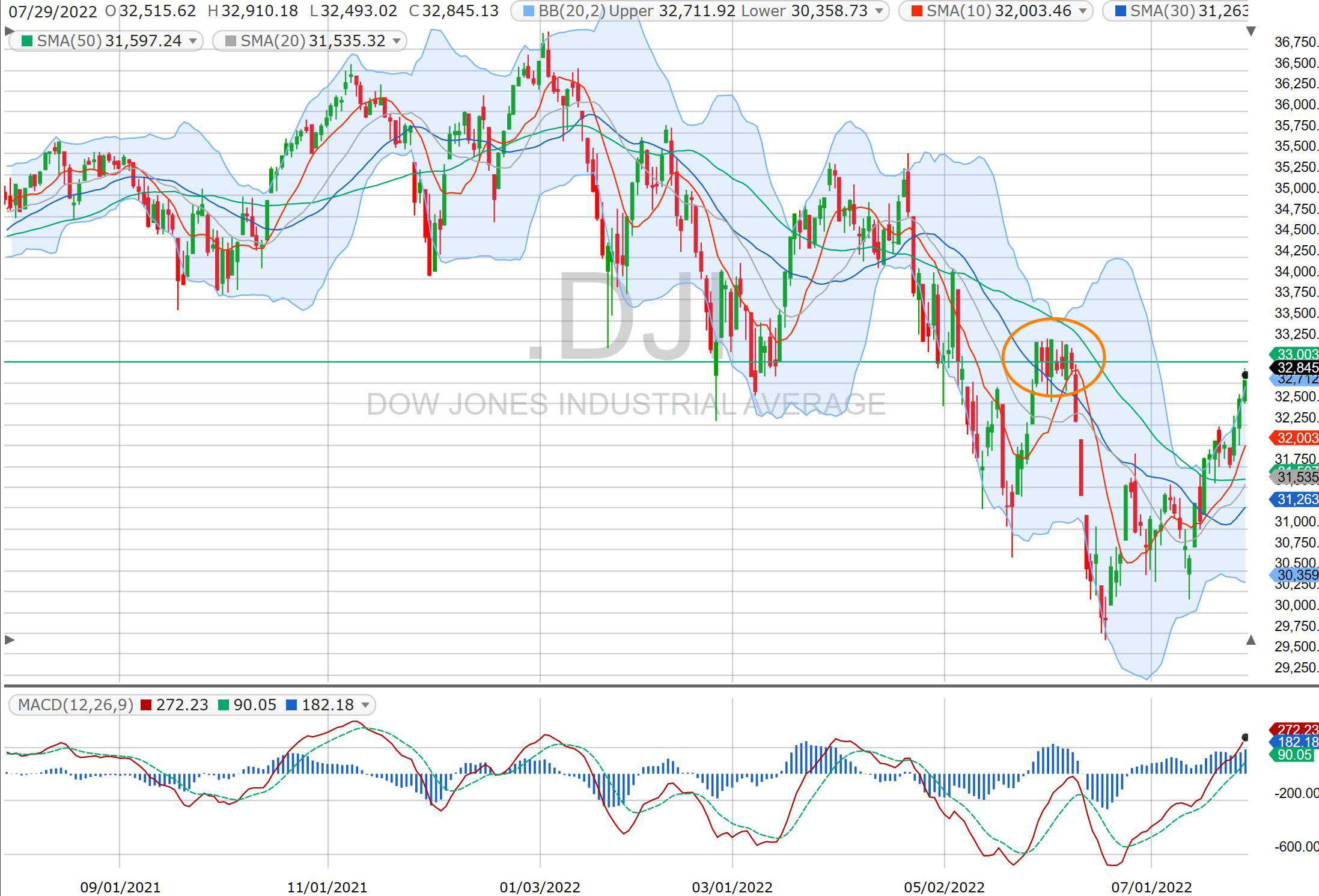

DJI

Comparatively, DJI seems to be the weakest of the three major indices. It is still below its respective June-congestion level. CAT and COKE are both reporting on Tuesday, and should be worth watching.

Trades

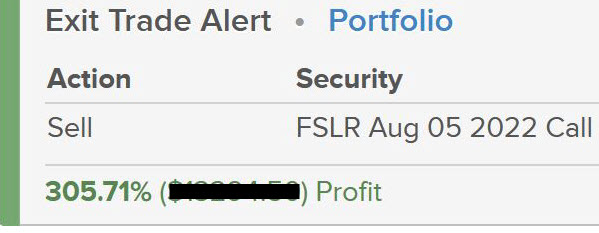

We made quite a few nice trades last week. On the upside, we caught the big jump in solar stocks after ENPH's better-than-expected earnings.

FSLR gave us an +306% win:

(for details on published trades, please click HERE)

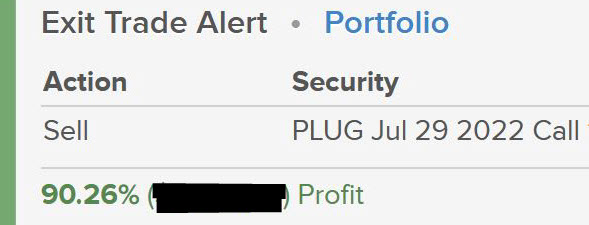

PLUG also scored a nice :

(for details on published trades, please click HERE)

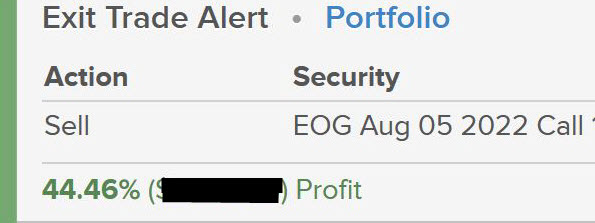

EOG

(for details on published trades, please click HERE)

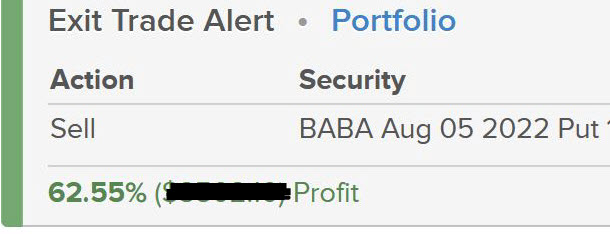

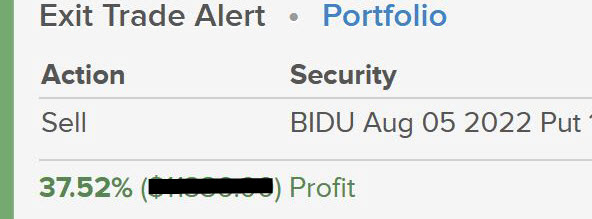

On the downside, we traded the trouble Chinese ADRs. Both BIDU and BABA puts rendered some healthy profits:

BABA

(for details on published trades, please click HERE

BIDU

(for details on published trades, please click HERE)

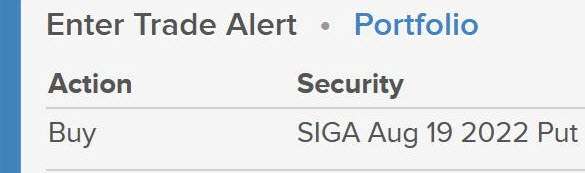

New Trades

The recent rise in Monkeypox cases have pushed some drug manufacturer stocks higher. One in particular is SIGA. Last week, this stock rose from below $14 to above $22, On Friday, we went in on the put-side when the stock was hovering just above $22:

(for details on published trades, please click HERE)

Even though Monkeypos cases have risen in the US and Europe, so far, in most cases, the symptoms are mild and resolve in two to four weeks.

I think the broader market will attempt to struggle upwards early this week, and we may start to see profit-taking later this week. But, of course, we will be watching individual stocks as they report earnings. Chinese ADRs appear to be entering into a new bearish phase and BABA will report on Thursday.

I'm watching for a possible breakout in NFLX, and a continue bounce in LMT.

Good morning and HappyTrading! ™

Recent free content from Andy Wang

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member