Three months ago, on August 10, 2020, I wrote an article bringing your attention to GBTC, a bitcoin ETF. At the time, GBTC was establishing a base at $13. I said, "I think within a few months, GBTC will test that $20-$22 range. This could be a good hedge against the market." Since then, bitcoin has been climbing, and today it hit above $18,000 intraday, which brought GBTC above $20:

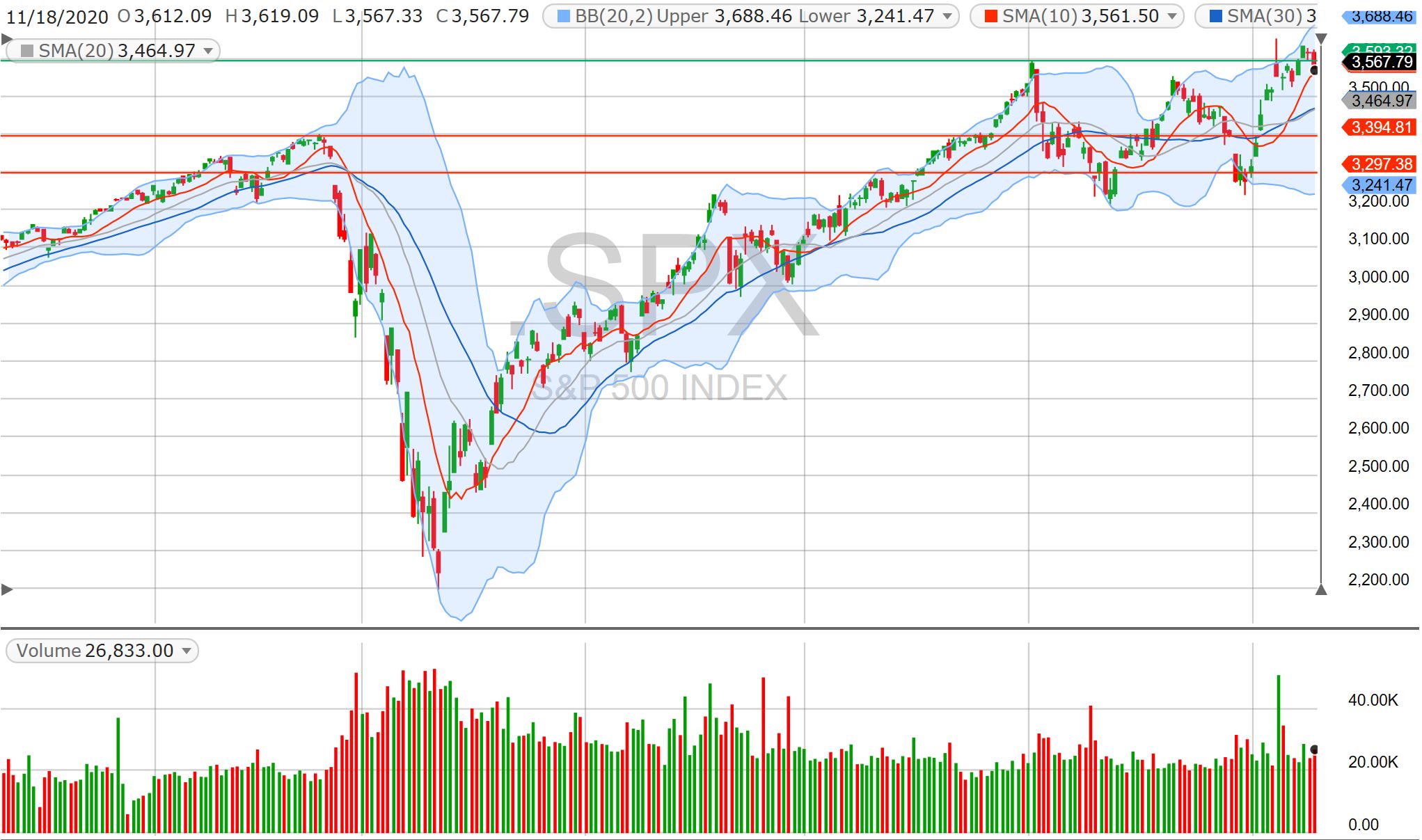

While GBTC has been shooting up higher, the over all market has been volatile and trading sideways. Even though major market indices made new highs a couple of days ago, the new highs were not by much, and they looked "stretched" (meaning it took a lot of effort just to get there), and the market closed in the red today, Wednesday:

So, be very careful on Thursday and Friday. This market is extended. NVDA reported great earnings and gave a fabulous report, and yet, its stock fell in the after-hours. This gives us a warning signal on the overall market conditions.

Gold and silver may need sometime to consolidate. Bitcoin can continue to go higher if it clears $18k; for GBTC, watch the resistance level between $20-22. So, I raised cash today. It may be time to gear up to play the downside. VIX spiked at the close today. Keep an eye on VIX and UVXY. UVXY has a resistance between $15-$16, above which things could get interesting.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

World Markets Tumble, As Oil Stays Weak!

— 1/18/16

World Markets Tumble, As Oil Stays Weak!

— 1/18/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member