It's been over 2 years since the COVID-19 Pandemic started. The vaccines stocks such as MRNA and BNTX had soared 5-fold before peaking in September of 2021. These stocks have come down almost 70% from their peaks in just a few months. Now, it seems like buying interests are coming back as new drugs are being developed and emerging onto the markets.

VERU, an oncology bio-pharmaceutical company, announced yesterday positive clinical-3 results of its orally administered drug in reducing deaths in moderate to severe COVID-19.

from Wall Street Reporter, April 11, 2022

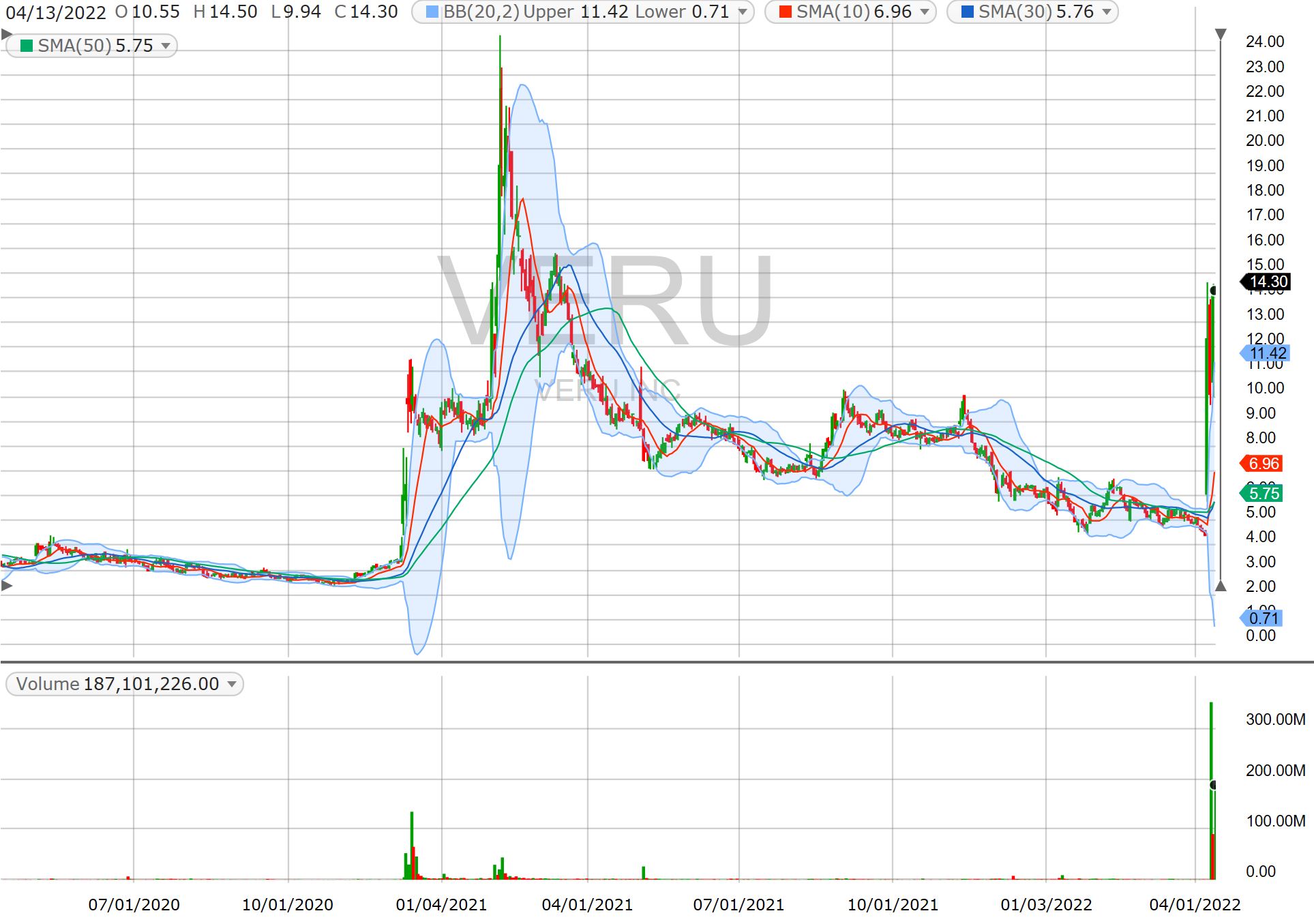

VERU stock soared from a closed of $4.35 on Friday, April 8, to close at $12.28 on Monday April 11. It pulled back on Tuesday to close at $10.01. On Wednesday, April 13, VERU stock popped again as Oppenheimer published a $36-target. VERU stock closed at $14.3 on Wednesday, another +42.86% gain.

From the daily charts, we can see a giant breakout in VERU, and that back in early 2021, it had traded above $24. Now that its clinical trials have produced positive results, it is not difficult to see that this stock could head back to the 20s, perhaps after some consolidation.

Options on this stock have high volumes, so VERU is a good candidate for options trading. Presently, May 10 calls are trading at $5.2/$5.3 and July 10 calls are trading at $5.5/$6.

MRNA stock jumped +6.37% or +$10.16 to close at $169.66 yesterday. From its daily chart we can see that it has established a near-term bottom, and the 30- and 50-day moving-averages are flattening out.

Very similar developments are happening on BNTX charts as well. However, MRNA options are much more liquid than those of BNTX. If these stock continue to rebound, we could see a near-term resistance for MRNA at around $240, and BNTX at around $220.

Good morning and HappyTrading! ™

Recent free content from Andy Wang

-

Stocks Coming Back Down

— 8/23/22

Stocks Coming Back Down

— 8/23/22

-

Stocks Ready For A Bounce

— 7/07/22

Stocks Ready For A Bounce

— 7/07/22

-

Consumer Stocks Take Hit: TGT, COST, DG, DLTR, MCD

— 5/18/22

Consumer Stocks Take Hit: TGT, COST, DG, DLTR, MCD

— 5/18/22

-

Two Quick Trades: FB, GME

— 5/12/22

Two Quick Trades: FB, GME

— 5/12/22

-

Dow Stocks Are Falling, and 3 Dow Stocks to Sell

— 5/12/22

Dow Stocks Are Falling, and 3 Dow Stocks to Sell

— 5/12/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member